Bitcoin has made a strong comeback, rising back to the $85,000 level after falling below $74,000 last week. While headlines focused on Donald Trump’s tariff proposals and growing macroeconomic uncertainty, major investors used the drop as a chance to accumulate—rather than sell.

As markets face economic pressure, Strategy, the company that holds the most Bitcoin in the world, is showing renewed confidence. After a short pause of about two weeks, Michael Saylor, Strategy’s co-founder, has signalled that the company is ready to buy more Bitcoin again.

Source: Strategy.com

Just recently, on March 31, Strategy added 22,048 BTC, bringing its total holdings to 528,185 BTC. On April 14, the company made another purchase of 3,459 BTC at an average price of $82,618. This brings Strategy’s total holdings to 531,644 BTC, with a year-to-date return of 11.4%.

This steady accumulation has caught global attention and is seen as a key indicator of growing long-term confidence in Bitcoin among institutional investors. Despite recent price drops, Bitcoin’s position as a reliable asset in times of uncertainty is becoming clearer, especially as global markets face stress.

Uncertainty driven by Trump’s tariff policy has caused massive selloffs in global risk assets. Stock markets have lost trillions in market value. The crypto market has also seen strong selling pressure.

Source: TradingView (Weekly Timeframe)

The Total3 index, which tracks the value of all cryptocurrencies except Bitcoin and Ethereum, has dropped over 32% from its December 2024 peak. In contrast, Bitcoin has only declined about 22% from its January high of $109,000 and is now trading around $84,000. Compared to global equity markets that lost more than $5 trillion, Bitcoin’s resilience stands out, reinforcing its image as a long-term store of value—not just a high-risk asset.

Source: CryptoQuant

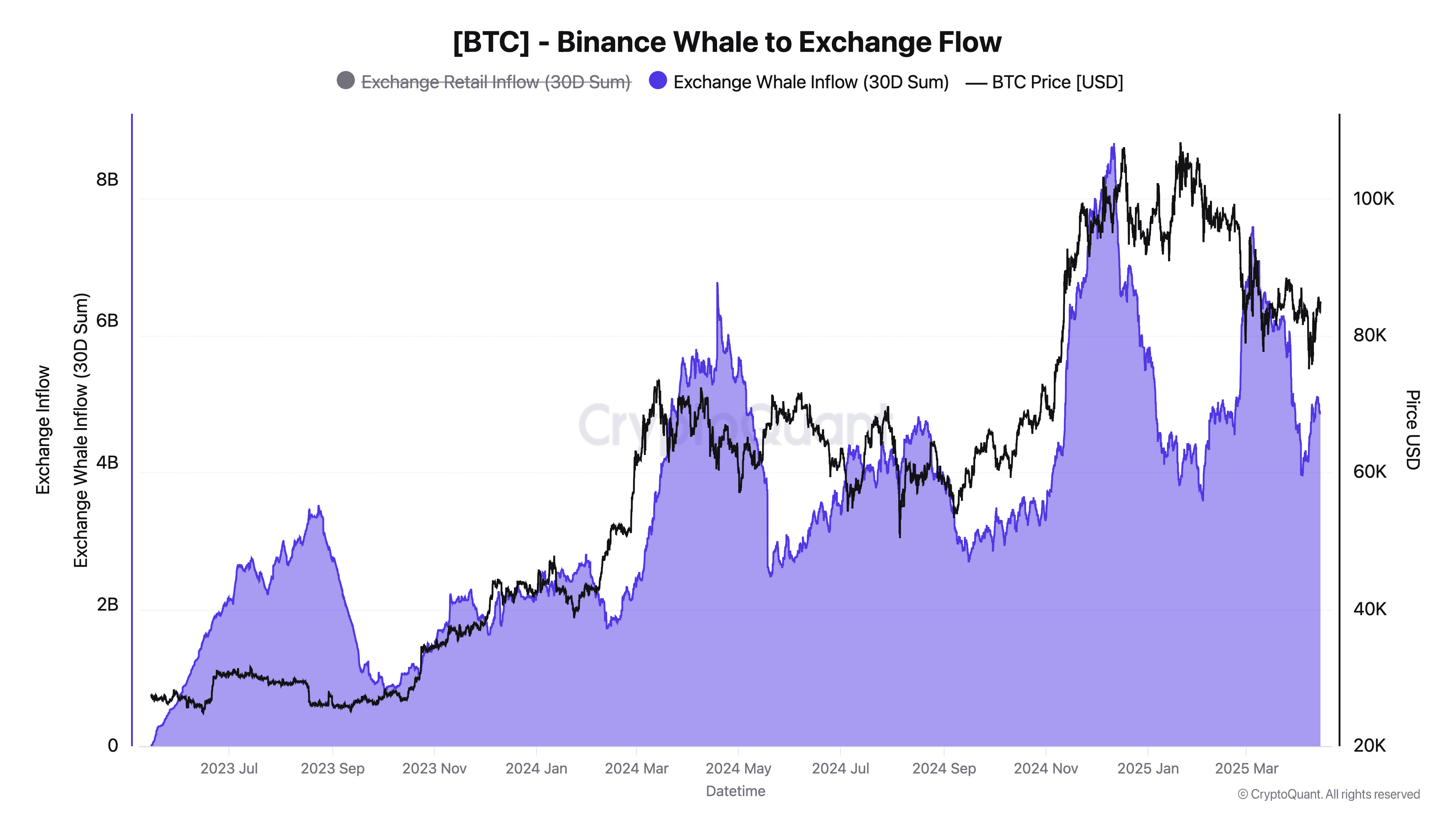

Despite recent price volatility, Binance whales, among the largest participants in the crypto market, continue to show no signs of panic. The 365-day average of the Exchange Whale Ratio is still rising, signalling ongoing whale activity.

Source: CryptoQuant

At the same time, whale inflows to exchanges dropped by $3.7 billion (from $8.4B in December 2024 down to $4.7B today). This decline suggests that whales are not moving assets for liquidation. In fact, it’s the opposite: lower inflows typically indicate that whales are holding onto their assets or accumulating more, not preparing to sell.

This behaviour aligns with historical patterns during previous correction periods, reinforcing the view that large players see the recent dip as a buying opportunity rather than a reason to exit the market.

A notable divergence is emerging between US institutional behaviour and global whale strategies. BlackRock’s IBIT fund alone saw $343 million in outflows last week, contributing to a broader $713 million institutional sell-off following Trump’s tariff announcement.

In contrast, experienced crypto whales have continued to hold strong positions. This divergence sets the stage for a potential short squeeze if institutions re-enter a more stable policy environment.

Bo Hines, Digital Asset Advisor to the President, has confirmed a new plan to use profits from gold reserves to purchase Bitcoin. The Bitcoin Act of 2025, supported by Senator Cynthia Lummis and President Trump, aims to buy 1 million BTC over five years—equal to 5% of the total supply. If the world’s reserve currency begins holding Bitcoin as a national asset, it would strongly reinforce Bitcoin’s long-term value.

While the federal plan develops, several US states are moving ahead. Florida and New Hampshire are proposing bills to invest up to 10% of state funds into Bitcoin. If 18 other states follow, this could bring up to $23 billion in new demand for BTC.

Around the world, countries like El Salvador continue leading Bitcoin adoption with national reserves and infrastructure projects. Other emerging markets are also looking at Bitcoin as a way to gain financial independence from the US dollar.

In the upcoming Q2-Q3 period, this is shaping up to be an excellent time to start accumulating Bitcoin. The cryptocurrency is currently in a consolidation phase, which often precedes a strong upward movement. This could very well be one of the best opportunities of this year.

Source: Tradingview (Weekly Timeframe)

Based on the chart, the current price level presents a solid entry point for Bitcoin accumulation. If the price pulls back towards the $72,000 level, or potentially dips slightly lower to around $64,000, this would provide even more favourable buying conditions. Such a pullback would set up a great base for potential upside movement, with key resistance levels at $88,000, $92,000, and $102,600.

Given the favourable market conditions and long-term bullish outlook, this period could represent a prime window for strategic accumulation.

Conclusion: Bitcoin is Evolving into a Global Reserve Asset

Bitcoin’s market outlook is supported by strong forces such as strategic whale accumulation, early-stage sovereign adoption, and a positive accumulation phase. While short-term volatility may persist due to ongoing Trump uncertainty, Bitcoin is steadily transitioning from a speculative asset to a globally recognised store of value.

If institutions are already recognising Bitcoin’s long-term potential, what’s preventing them from re-entering the market now? Could it be that they are waiting for more favourable conditions? And when they do return, will they be able to acquire Bitcoin at current prices, or will they face higher costs as demand increases? With smart money already positioning itself, it becomes evident that Bitcoin is set on a path to further solidify its role as a dominant global reserve asset.

Disclaimer: 2026. All rights reserved. This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in cryptocurrency markets involves substantial risk, including the potential loss of your entire investment. Users are advised to conduct their own research, exercise caution, and seek independent financial advice before making any trading decisions. BitDelta is not liable for any losses or damages arising from actions taken based on this communication.