Whether you are a seasoned trader or just starting your journey in the world of digital assets, you’ve likely heard the word “leverage” spoken with both excitement and caution. That’s because leverage is one of the most powerful tools in crypto trading and one of the riskiest if misunderstood.

Archimedes once said, “Give me a lever long enough and a place to stand, and I shall move the world.”

In crypto trading, leverage might be that lever. It allows traders to control positions much larger than their actual account balance.

BitDelta offers up to 100x leverage, giving both beginners and professionals the flexibility to trade efficiently. Let’s break down how it works in a simple, human way without the confusing jargon.

At its core, leverage is a buying-power multiplier. It allows you to borrow funds from the exchange so you can open a larger trade than your capital alone would allow.

Think of it like this:

If you have $1,000 and use 25x leverage, you can open a position worth $25,000. Your $1,000 acts as collateral, while the exchange temporarily provides the rest.

This mechanism is used in futures and derivatives trading, not spot trading.

Understanding these three terms is essential before using high leverage.

Let’s say you have $100 and expect Bitcoin’s price to rise.

Without leverage (1x):

A 10% price move earns you $10

With 25x leverage:

Your $100 controls a $2,500 position

A 10% price move earns you $250

That’s a 250% return on your initial margin.

Leverage is a double-edged sword. While profits increase, losses are amplified at the same rate. With 25x leverage, your liquidation zone is very close. A move of roughly 4% against your position can wipe out your margin completely. In crypto markets, where prices can swing rapidly, this can happen faster than many expect. Liquidation exists to protect the exchange from losses, but for traders, it means:

Your position is closed automatically

You lose most or all of your margin

This is why leverage without risk management is not trading, it’s gambling.

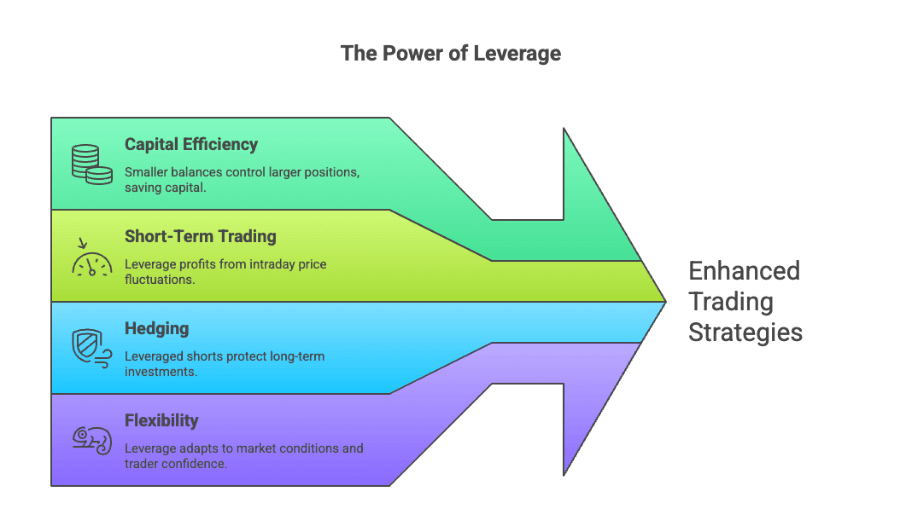

Traders use leverage not just to chase bigger profits, but to trade more efficiently. With leverage, you can control a larger position while keeping more of your capital free for other opportunities. Some traders use higher leverage with smaller position sizes to reduce the amount of margin locked into one trade. Others use it to benefit from smaller price moves, especially in fast-moving markets where short-term volatility creates frequent opportunities.

Despite the risks, both beginners and professionals use leverage for strategic reasons: The key difference between successful and unsuccessful traders isn’t leverage it’s how responsibly it’s used.

When trading with leverage, you will usually see two margin options: Isolated and Cross. With Isolated Margin, the risk is limited only to the margin you allocate to that specific trade, meaning if the position goes wrong, the maximum loss is largely contained within that isolated amount. With Cross Margin, your position can draw from your available account balance to reduce the chances of liquidation, but this also means your wider balance is exposed if the market continues moving against you. For most beginners, isolated margin is often safer because it helps control downside risk and avoids a single bad trade impacting the full account.

If you are new to leverage, the safest approach is to start small and treat leverage as a learning tool, not a shortcut. Many traders lose money not because the market is “rigged”, but because they trade oversized positions without a clear exit plan. Professionals treat leverage with discipline: they control position size, use stop-losses, and accept small losses quickly rather than hoping the market turns. The goal is not to win every trade, but to survive long enough to build consistency.

Many new traders believe leverage is a fast path to success. In reality, leverage simply magnifies your strategy good or bad.

A solid strategy + leverage = efficiency

A weak strategy + leverage = fast losses

This is why professional traders often use high leverage with small position sizes, not reckless exposure.

Our exchange offers 25x leverage to empower traders not to encourage unnecessary risk. When used correctly, leverage allows you to trade smarter, manage capital efficiently, and take advantage of market opportunities. Whether you’re a beginner learning the basics or a professional refining your edge, the secret isn’t the leverage itself it’s how well you control it.

Start with a plan. Respect the market. Use leverage wisely.

Disclaimer: 2026. All rights reserved. This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in cryptocurrency markets involves substantial risk, including the potential loss of your entire investment. Users are advised to conduct their own research, exercise caution, and seek independent financial advice before making any trading decisions. BitDelta is not liable for any losses or damages arising from actions taken based on this communication.

5 mins

Dec 5, 2025