If you are stepping into the world of cryptocurrency, even if it’s just to buy a small amount of Bitcoin, you will need a crypto wallet. It is not just a convenience; it is a necessity. Think of it as your digital key ring. It keeps your assets safe, grants access when needed, and ensures that you have control.

It might sound simple, but behind that simplicity lies a fascinating system of cryptographic technology, blockchain interactions, and wallet types, each offering its advantages and risks.

This blog is here to walk you through everything about cryptocurrency wallets: how they work. The different wallets available, and how to choose one that fits your needs? By the time you finish reading, you will be well-equipped to manage your digital assets with confidence.

A cryptocurrency wallet is a digital tool used to store and manage the cryptographic keys that give you access to your digital assets. Unlike a traditional wallet that holds physical cash, a crypto wallet does not store coins in the conventional sense. Instead, it stores your public and private keys, which are essential for proving ownership and performing transactions on the blockchain.

Here is a simple way to think about it:

Losing your private key is equivalent to losing access to your vault with no spare key and no help desk to retrieve it. That is why securing it properly is very important.

To understand how wallets work, you need to understand the underlying technology: blockchain. Blockchain is a digital ledger where all cryptocurrency transactions are recorded. It is transparent, decentralised, and immutable. Your wallet does not store actual coins. Instead, it stores access credentials in the form of cryptographic keys and uses them to interact with the blockchain.

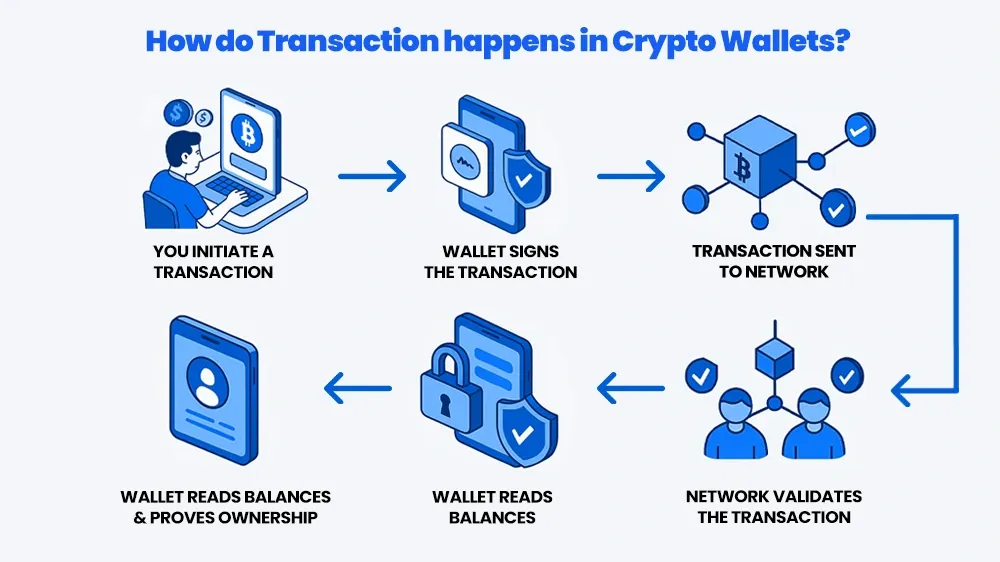

Here is what happens when you send or receive cryptocurrency:

Your wallet acts as a secure interface to read your balances, manage transactions, and prove ownership of funds using cryptography.

There are various types of wallets available depending on your experience level and goals. Wallets are broadly classified into two categories:

Let’s break down the major types.

Hosted wallets are often the easiest way for newcomers to start their crypto journey. These wallets are managed by a third-party provider, typically the exchange where you buy your crypto. For example, if you buy crypto on BitDelta and store it on your account there, you are using a hosted wallet. The platform manages your keys on your behalf.

This means you do not need to worry about private key storage, recovery phrases, or technical setup. You simply log in and use your funds. Hosted wallets are ideal for:

One important note: since the exchange holds your private key, you are trusting them to keep your crypto safe. That makes it essential to use only reputable platforms like BitDelta.

If you want full control over your digital assets, a non-custodial wallet is a better fit. These wallets do not involve third parties. You are the sole owner of your private key.

Non-custodial wallets are typically software-based and come in the form of mobile apps, browser extensions, or desktop applications. They are especially popular among users who explore the decentralised finance (DeFi) space, buy or sell NFTs, or stake their crypto.

With this freedom comes responsibility. If you lose your private key or seed phrase, there is no way to recover your wallet. It is your responsibility to keep these credentials secure. Non-custodial wallets are suitable for:

Make sure to write down your seed phrase and store it offline in a secure location.

A hardware wallet is a physical device that stores your private keys offline. These wallets are designed for long-term storage and offer a higher level of security against online threats. Because they are disconnected from the internet, they are extremely difficult to hack. Your private key never leaves the device, and transactions are signed within the hardware itself. Hardware wallets are best for users who:

If you choose a hardware wallet, make sure to keep both the device and your recovery phrase safe. If you lose both, your funds are unrecoverable.

Crypto wallets can be very safe if used properly. The real risk often lies in how the user handles the wallet rather than the technology itself. Follow these best practices to stay secure:

Crypto puts you in control, but that also means it is up to you to protect your assets. At BitDelta, we encourage users to start with hosted wallets for ease, but we also educate them about non-custodial and hardware wallets as they gain experience.

The right wallet for you depends on your needs and how you plan to use your crypto. Here are some common use cases and the type of wallet that fits best:

Before downloading or purchasing a wallet, ensure:

Always prioritise safety, especially when it involves real financial value.

As cryptocurrencies continue to gain global adoption, understanding how to store and manage your assets securely is a vital skill for anyone in the space. A crypto wallet is more than a digital tool. It is your gateway to participating in the blockchain economy. Whether you are trading, investing, exploring DeFi, or simply holding crypto for the long term, your wallet is the key that unlocks those opportunities.

Learning how different wallets work and using them safely is one of the most important steps in your crypto journey. It allows you to move confidently in a space where control and responsibility go hand in hand. With the right wallet and best practices, you can take full ownership of your digital assets and be in control of your financial future.

Q) What is a crypto wallet, and why do I need one?

A crypto wallet is a digital application or device that stores your private and public keys. You need one to access, send, or receive cryptocurrency securely.

Q) How does a crypto wallet work?

It connects to the blockchain and manages your private key, allowing you to initiate and verify transactions. It does not store coins but rather proves your ownership.

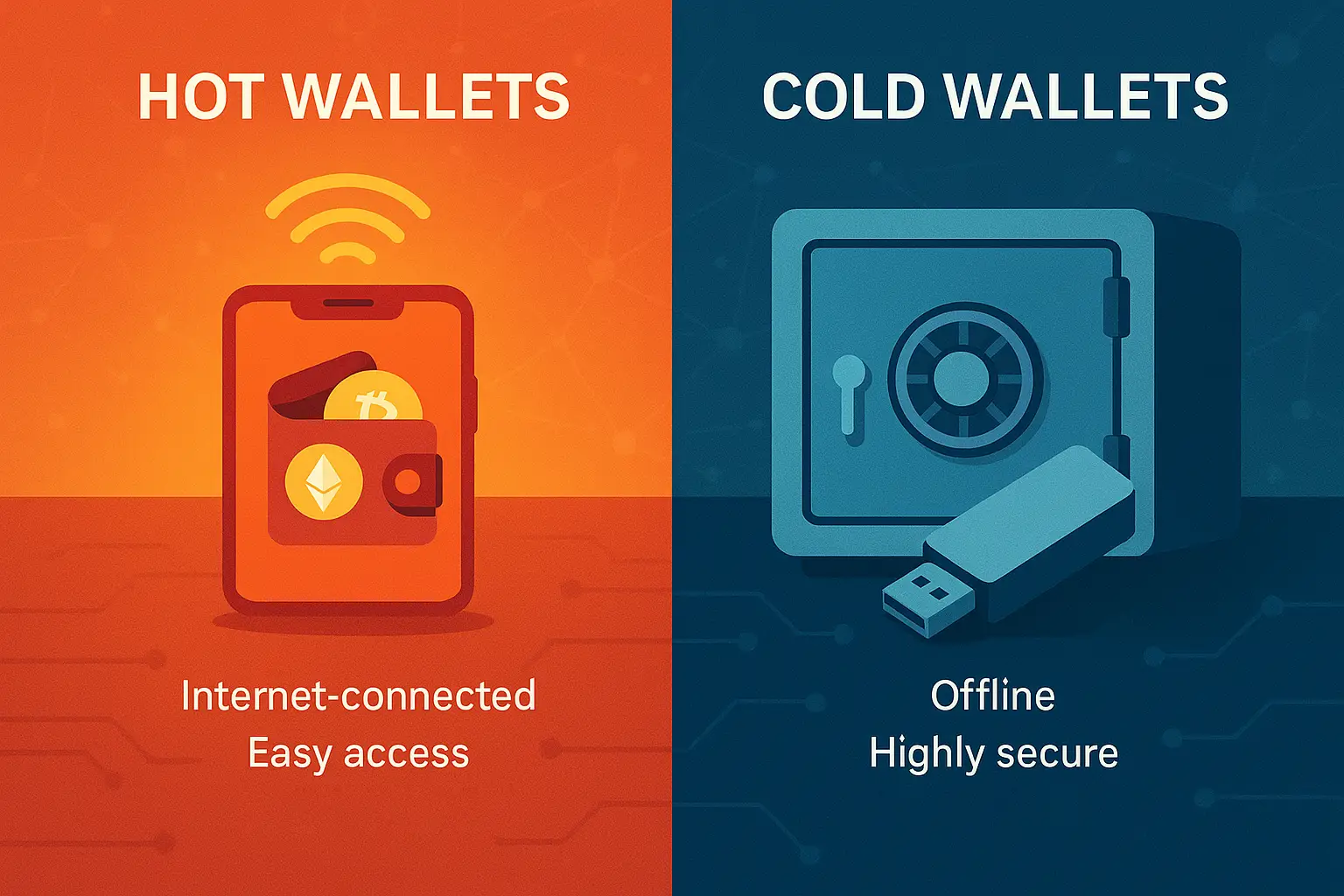

Q) What is the difference between hot and cold wallets?

Hot wallets are connected to the internet and are easier to use but slightly more vulnerable to hacks. Cold wallets are offline, making them more secure but less convenient for frequent use.

Q) Are crypto wallets safe?

Yes, but only if used correctly. Proper backups, strong passwords, and offline storage of keys are essential for maintaining wallet security.

Q) What types of wallets are available?

There are hosted (custodial) wallets, non-custodial wallets, software wallets, mobile wallets, desktop wallets, and hardware wallets. Your choice should depend on how you plan to use and manage your crypto.

Disclaimer: 2026. All rights reserved. This communication is for informational and educational purposes only and should not be construed as financial, investment, or legal advice. BitDelta does not guarantee the accuracy, completeness, or timeliness of the information provided. Trading in cryptocurrency markets involves substantial risk, including the potential loss of your entire investment. Users are advised to conduct their own research, exercise caution, and seek independent financial advice before making any trading decisions. BitDelta is not liable for any losses or damages arising from actions taken based on this communication.